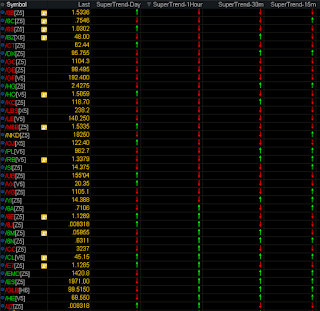

Trends can be classified as primary, intermediate and short term. However, markets exist in several time frames simultaneously.

As such, there can be conflicting trends within a particular stock depending on the time frame being considered.

It is not out of the ordinary for a stock to be in a primary uptrend while being mired in intermediate and short-term downtrends.

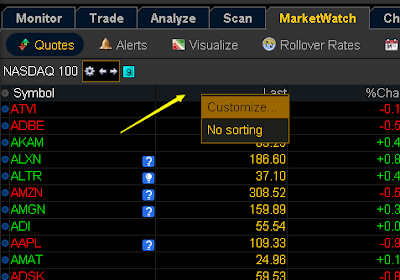

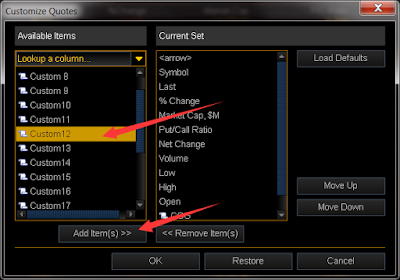

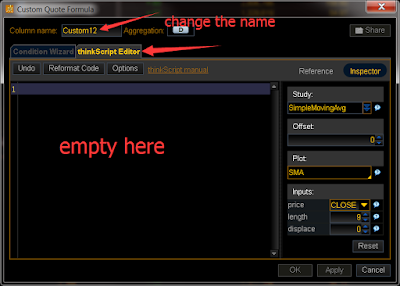

It's very important to keep track of all trends, and using a screener is the only way to do it.

The pictures only show 3 different timeframes.

But you can have all of the following timeframes listed on the screen at the same time.

All time frames:

MIN

TWO_MIN

THREE_MIN

FOUR_MIN

FIVE_MIN

TEN_MIN

FIFTEEN_MIN

TWENTY_MIN

THIRTY_MIN

HOUR

TWO_HOURS

FOUR_HOURS

DAY

TWO_DAYS

THREE_DAYS

FOUR_DAYS

WEEK

MONTH

OPT_EXP