The definition of divergence is when price and indicator move in different direction,

for instance, when price is in uptrend and reaches a higher high where the indicator is in downtrend.

What is ADX Triple Divergence?

The concept of triple divergence is intuitional, if there are three continueous divergences in a row between current High and previous Peak then it will trigger a signal.

More signals is not necessary a bad thing, but a signal (Triple Divergence) is confirmed via short, mid and long terms could be more solid.

It doesn't necessarily mean the Triple Divergence is definitely better than the normal version, they detect signals from different angles.

Features:

- Instant signal on current(last) bar, no repaint.

- Alert when a signal appear.

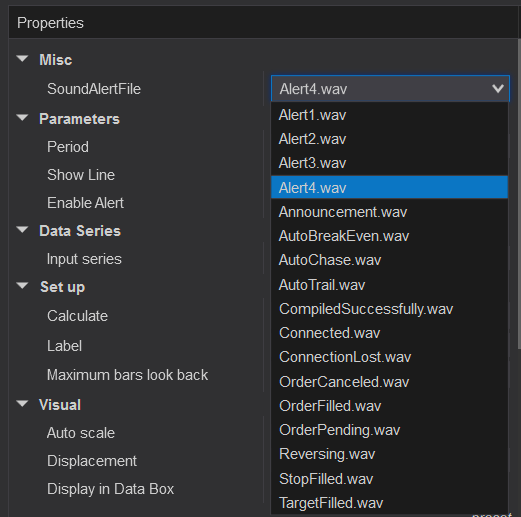

- Select different sound alert files.

- Enable to show lines between Highs and Lows.

- Please note: it doesn't work in Renko chart.

- Market Analyzer with alert.

It also comes with a Market Analyzer which makes it possible to track signals within any timeframe. The input "Range" is used to check if there was a signal within the given number of bars.

You can add more than one column as different timeframes with different settings.

The following chart is a bullish ADX triple divergence.

A bearish ADX triple divergence is shown in the chart below

Why Triple Divergence? Is it better than normal divergence?

I have seen many divergence indicators on different platforms but they only check the divergence in one of the three terms, short-term, mid-term or long-term. Regular divergence indicator will not exam all three terms at the same time, but Triple Divergence is capable of completing the task.

Sometimes there are too many divergence appear in a short range for the normal divergence indicator.

No comments:

Post a Comment